Latest Vertical Farming Market Size, Growth, and Statistics

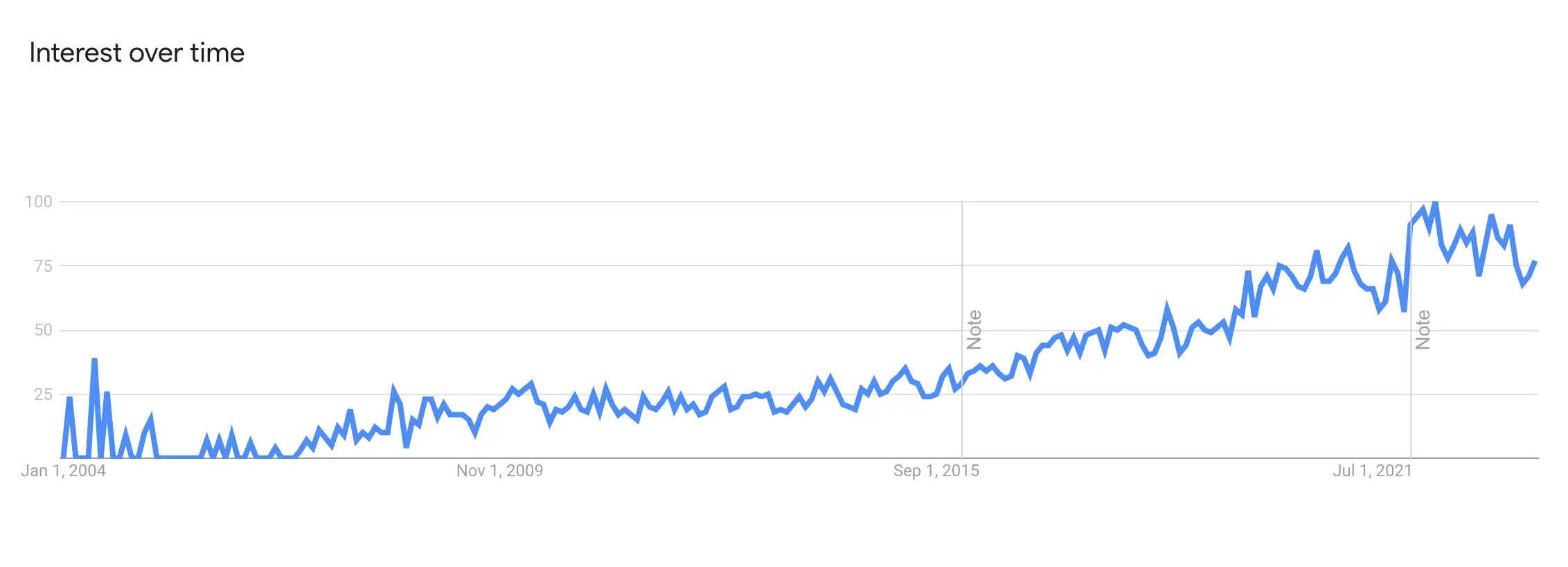

Interest in vertical farming has been soaring exponentially since its inception in 1999.

Vertical farming has grown rapidly due to new technologies, local food demand, and limited resources.

This report looks at the latest market size, growth trends, and key statistics that showcase the momentum vertical farming is gaining globally.

Vertical Farming Industry Highlights

Vertical Farming Market Size

As of 2023, the global vertical farming market is worth over $5.1 billion.

The growth of the vertical farming market is influenced by several factors, including the efficient use of resources, the increasing popularity of organic food, the convenience of monitoring and harvesting crops, and declining available farmland, among others.

The vertical farming market was dominated by North America, which acquired the most significant revenue share of 35% in 2022.

In 2023, North America accounts for the largest market share in the Vertical Farming Market.

Sources: PR Newswire, Mordor Intelligence, Allied Market Research, GlobeNewswire, Grand View Research

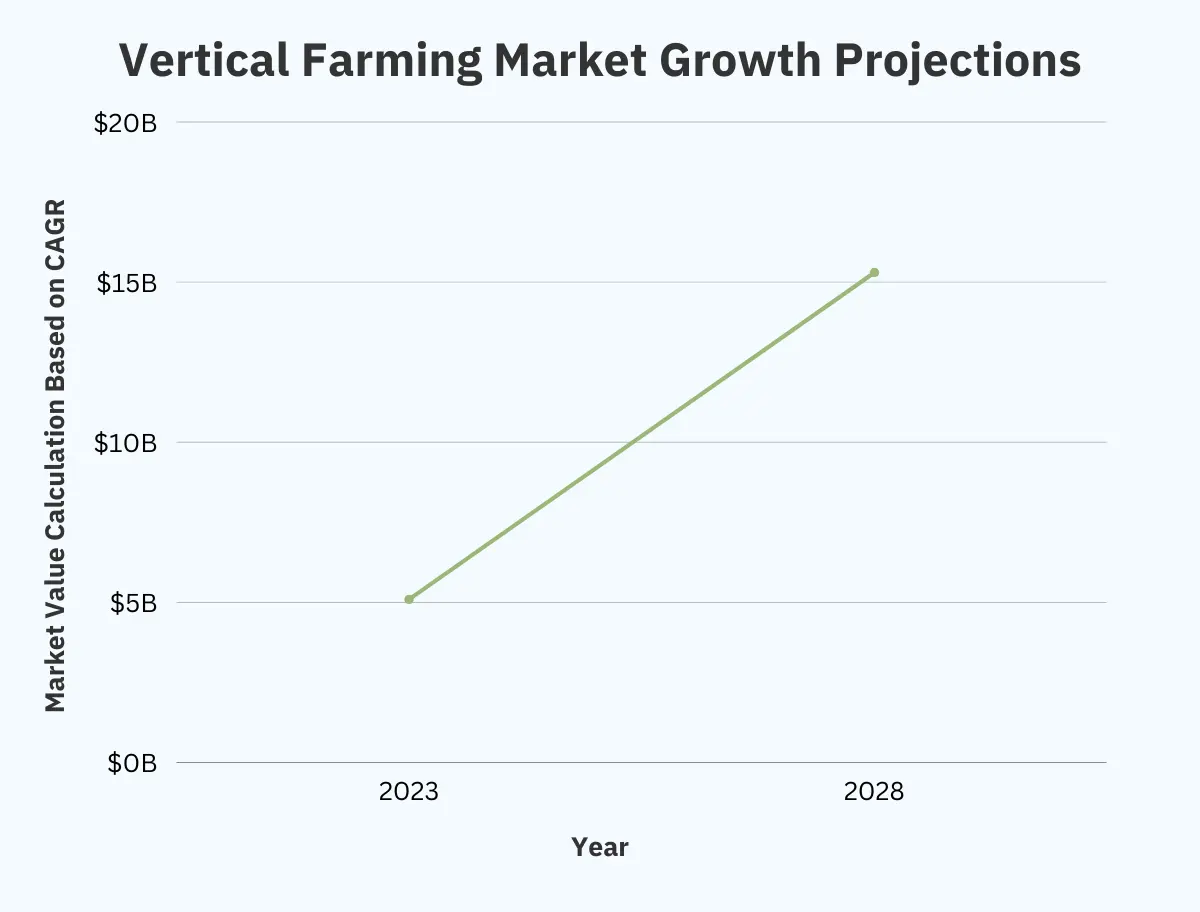

Vertical Farming Market Growth Projections

The vertical farming market is projected to reach $15.3 billion by 2028.

The market is expected to grow at a compound annual growth rate (CAGR) of 24.7%.

Sources: PR Newswire

Vertical Farming Adoption Statistics

The USA has the highest number of vertical farms, while in Asia, the leading countries in the industry are Japan, China, Singapore, South Korea, Taiwan, and Thailand.

In Europe, vertical farms can be found in Germany, France, the UK, and the Netherlands.

Countries from the Middle East also have vertical farms, such as Kuwait and UAE.

The US market has witnessed a significant emergence of new vertical farms across the country and the early adoption of urban farming in the country results in high demand for vertical farming produce.

Middle East is another market with high growth potential for vertical farming, as the climate in Middle Eastern countries is hot for almost eight months a year, leaving a significantly less favorable period for crop production.

A scoping review of vertical farming technologies in Sub-Saharan Africa’s agricultural sector found that the majority of individuals adopting the technology are smallholders, who make up the largest share of farmers in the region.

These smallholders are mostly adopting the low-complexity-technological form of vertical farming, while the adoption of the high-complexity-technological form of vertical farming is also slowly on the rise.

Sources: Semantic Scholar, Grand View Research, Forbes

Vertical Farming Funding Statistics

In 2022, indoor vertical farming companies received a total investment of $2.4 billion.

In the first three months of 2023, indoor farms raised $75.8 million globally across 14 deals, down 70% in deal value from the previous quarter.

In 2022, indoor farming startups alone captured around 20% of the total $4.5 billion venture investors put into agtech startups.

Sources: Crunchbase, PitchBook, iGrow News

Key Players In The Vertical Farming Market

These companies provide different ways to grow crops, like using lights, sensors, and software. They also offer services for controlling climate and have different structures and crop types.

Sources: MarketsandMarkets, Grand View Research, Allied Market Research, Mordor Intelligence, Fortune Business Insights, GlobeNewswire

Vertical Farming Market Segments

The vertical farming market is divided into different categories, such as growth mechanism, structure, crop type, offering, and region.

Here are some of the key segments:

Sources: MarketsandMarkets, Mordor Intelligence

Conclusion

The exponential growth of the vertical farming industry is nothing short of remarkable.

The leaders of this farming revolution are increasing yields and reducing resources with advanced methods like hydroponics, aeroponics, LED lights, and climate control.

Vertical farms that use data to grow crops are not only good for the environment, but they also produce healthy food without pesticides.

However, work remains to be done around reducing high upfront costs and energy demands.

Vertical farming is still in its early days. It has only scratched the surface of its immense disruptive potential.

Meet your guide

Dhruvir Zala